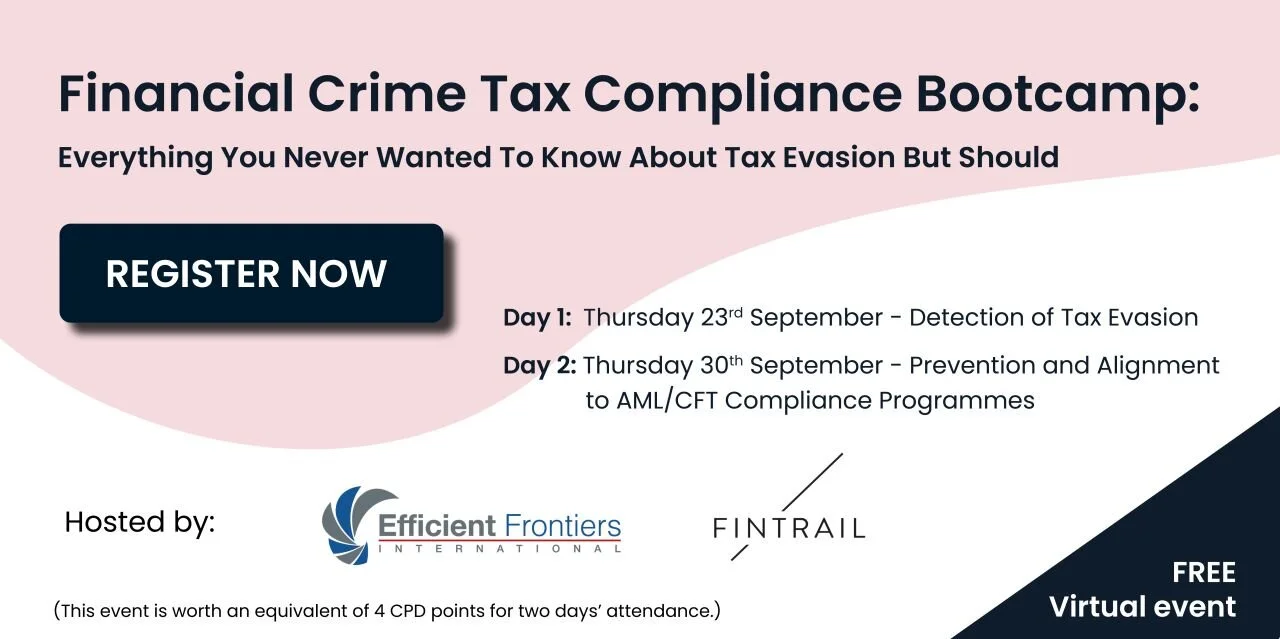

Efficient Frontiers International and FINTRAIL bring you the ultimate Financial Crime Tax Compliance Bootcamp.

Following the addition of new 'tax triggers' under the 5th Anti-Money Laundering Directive (5AMLD), we discuss:

Day 1: 23rd September, 15:00 – 17:00 BST - Detection of Tax Evasion

Session 1 - Tax Evasion: Who wins, who loses and why we should care? Martin Woods, Chair of Advisory Board of Global Compliance Institute

Session 2 - What is tax evasion and why is it a predicate offence under AML Regulations? Maya Braine, FINTRAIL, Subject Matter Expert

Session 3 - Tricks, tactics and tell-tale signs: Tax evasion red flags – Part 1. Sam Gibb-Cohen, HMRC, Assistant Director, Financial Sector Fraud Lead, Large Business, London and Stacey Mills-Kelly, HMRC’s Counter Fraud Banking Lead

Session 4 - Tricks, tactics and tell-tale signs: Tax evasion red flags – Part 2. Jeff Bateman, Director of Operations, EFI and Jayne Newton, Director of Regulatory Expertise, EFI

Session 5 - How Tax KYC and AML KYC go hand in hand. Jayne Newton, Director of Regulatory Expertise, EFI

Day 2: 30th September, 15:00 – 17:00 BST - Prevention and Alignment to AML/CFT Compliance Programmes

Session 1 - New KYC Review Requirements – Tax meets AML at the crossroads. Jayne Newton, Director of Regulatory Expertise,

EFI Session 2 - Follow the breadcrumb trail… investigation of a tax crime case. Andy Cole, CBE

Session 3 - When the tax investigators come knocking... responding to requests for information and investigations. Leslie Allen – Partner, Barrister, Mishcon de Reya LLP

Session 4 - The final session brings together all the key learnings over the two days, including the tools and controls that can help prevent tax crime.